What is a typical working day for a financial planner? The day starts off with prospecting. Next comes client relationship building. Finally, there is continuing education. There are many other areas of the day but these are the main parts of any financial adviser's workday. They are all covered in this article. Marketing and continuing education are also topics that need to be discussed. Hopefully this article will give you some insight into how to manage your money.

Prospecting

Many advisors hope for referral leads, or they expect to be found by the client by visiting their website or newspaper ad. It is true that the top 1% does a lot more prospecting than most advisors. For those with a warm market, it is possible to focus on sponsorship events and building a website. Prospecting can be a daunting task for new advisors. Opportunities include creating blogs, building a strong online presence and many other things.

If you are a novice financial advisor, most of your day will be spent developing a network of referrals and meeting prospects in person. An experienced advisor will focus more on attending networking events and sponsoring corporate events. No matter what method you choose to use, your goal is always to meet a prospect. Prospecting is difficult. But once you've got the hang of it, your prospects will be excited to meet you.

Establishing client relationships

Honest communication is an important part of client relations building. Clients should feel comfortable speaking with advisors about their financial problems. Building trust can be achieved by being open and honest about missed deadlines or mistakes. It doesn't matter if a client has never been to financial planning before or how experienced they are, it is important to be open and transparent when discussing their future goals and plans. A positive client experience is key to a long-lasting relationship.

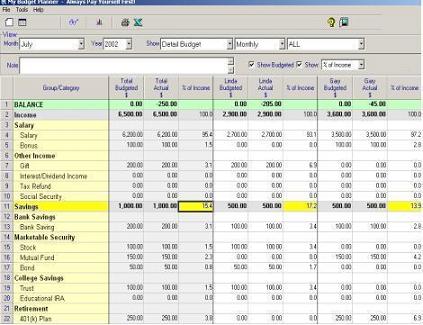

Financial advisors may spend their day filling with paperwork, legal documents, and spreadsheets. But, the most important task they have is maintaining client relationships. Trust is the foundation of a business model. While shoppers can trust products and services bought at a grocery store, financial advisors must be trusted by clients. In short, financial advisors have to win their clients' trust which in turn leads to increased client growth.

Continuing education

In today's world, Continuing Education for Financial Advisors (CEFA) is essential to the success of financial advisors. The industry is constantly evolving and there is a greater need for continuing education than ever. Financial advisors are affected by regulatory organizations, industry trends, as well as diverse demographics. Financial advisors today need to be knowledgeable about new products and where they fit in the financial constellation.

A recent survey done by the Centre for Life Insurance and Financial Education on more than 500 financial advisors in six Canadian provinces found that nearly 30% did not know sales training was not eligible for CE credit. The survey found that sales training is not CE for financial advisers. Continuing education for Financial Advisors is a key part of keeping your license current and maintaining your knowledge in the field.

Marketing

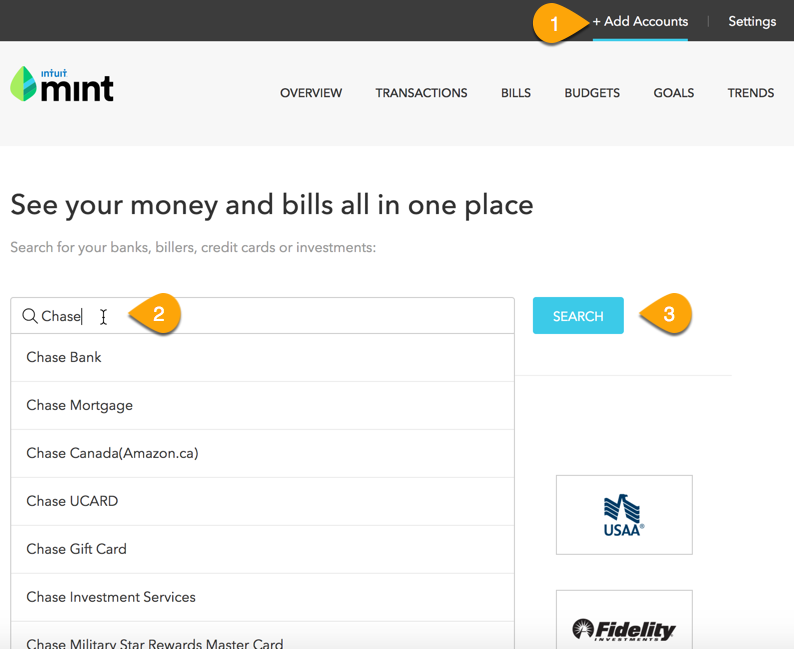

One day in the marketing life of a financial planner involves many activities. This could include creating a website, marketing your services via email, and setting up social media profiles. Marketing requires planning. You should take the time to find the right approach for you business. A marketing day in a financial advisor's life will not only help to attract new clients, it will also help expand your business.

You will be able to stay focused and reach your business goals if you have clear goals. The first goal could be to get a business license. Next, you might want to land your first client. As your company grows, you can set bigger goals such as 10 new clients per annum or achieving a particular commission level. Clear goals can help you and all your employees to see the direction of your company. These strategies will help make your marketing day a success.

FAQ

Who can I trust with my retirement planning?

Retirement planning can prove to be an overwhelming financial challenge for many. You don't just need to save for yourself; you also need enough money to provide for your family and yourself throughout your life.

You should remember, when you decide how much money to save, that there are multiple ways to calculate it depending on the stage of your life.

If you're married, for example, you need to consider your joint savings, as well as your personal spending needs. If you're single, then you may want to think about how much you'd like to spend on yourself each month and use this figure to calculate how much you should put aside.

You could set up a regular, monthly contribution to your pension plan if you're currently employed. It might be worth considering investing in shares, or other investments that provide long-term growth.

Contact a financial advisor to learn more or consult a wealth manager.

How to Begin Your Search for A Wealth Management Service

If you are looking for a wealth management company, make sure it meets these criteria:

-

Has a proven track record

-

Is it based locally

-

Consultations are free

-

Supports you on an ongoing basis

-

Clear fee structure

-

A good reputation

-

It is easy and simple to contact

-

We offer 24/7 customer service

-

Offers a range of products

-

Low fees

-

Does not charge hidden fees

-

Doesn't require large upfront deposits

-

Have a plan for your finances

-

Is transparent in how you manage your money

-

Makes it easy to ask questions

-

You have a deep understanding of your current situation

-

Understanding your goals and objectives

-

Are you open to working with you frequently?

-

Works within your financial budget

-

Have a solid understanding of the local marketplace

-

Would you be willing to offer advice on how to modify your portfolio

-

Is available to assist you in setting realistic expectations

Why it is important to manage your wealth?

The first step toward financial freedom is to take control of your money. Understanding how much you have and what it costs is key to financial freedom.

You must also assess your financial situation to see if you are saving enough money for retirement, paying down debts, and creating an emergency fund.

If you don't do this, then you may end up spending all your savings on unplanned expenses such as unexpected medical bills and car repairs.

What are the Benefits of a Financial Planner?

A financial plan will give you a roadmap to follow. You won’t be left guessing about what’s next.

This gives you the peace of mind that you have a plan for dealing with any unexpected circumstances.

A financial plan will help you better manage your credit cards. You will be able to understand your debts and determine how much you can afford.

Protecting your assets will be a key part of your financial plan.

Do I need to pay for Retirement Planning?

No. No. We offer FREE consultations so we can show you what's possible, and then you can decide if you'd like to pursue our services.

What is retirement planning?

Financial planning includes retirement planning. It helps you plan for the future, and allows you to enjoy retirement comfortably.

Planning for retirement involves considering all options, including saving money, investing in stocks, bonds, life insurance, and tax-advantaged accounts.

What are the Different Types of Investments that Can Be Used to Build Wealth?

There are many types of investments that can be used to build wealth. Here are some examples.

-

Stocks & Bonds

-

Mutual Funds

-

Real Estate

-

Gold

-

Other Assets

Each has its own advantages and disadvantages. Stocks and bonds can be understood and managed easily. However, they can fluctuate in their value over time and require active administration. However, real estate tends be more stable than mutual funds and gold.

It's all about finding the right thing for you. It is important to determine your risk tolerance, your income requirements, as well as your investment objectives.

Once you have determined the type of asset you would prefer to invest, you can start talking to a wealth manager and financial planner about selecting the best one.

Statistics

- As previously mentioned, according to a 2017 study, stocks were found to be a highly successful investment, with the rate of return averaging around seven percent. (fortunebuilders.com)

- A recent survey of financial advisors finds the median advisory fee (up to $1 million AUM) is just around 1%.1 (investopedia.com)

- According to Indeed, the average salary for a wealth manager in the United States in 2022 was $79,395.6 (investopedia.com)

- US resident who opens a new IBKR Pro individual or joint account receives a 0.25% rate reduction on margin loans. (nerdwallet.com)

External Links

How To

How to Invest Your Savings to Make Money

You can generate capital returns by investing your savings in different investments, such as stocks, mutual funds and bonds, real estate, commodities and gold, or other assets. This is called investing. You should understand that investing does NOT guarantee a profit, but increases your chances to earn profits. There are many different ways to invest savings. These include stocks, mutual fund, gold, commodities, realestate, bonds, stocks, and ETFs (Exchange Traded Funds). These methods are described below:

Stock Market

The stock market allows you to buy shares from companies whose products and/or services you would not otherwise purchase. This is one of most popular ways to save money. Also, buying stocks can provide diversification that helps to protect against financial losses. In the event that oil prices fall dramatically, you may be able to sell shares in your energy company and purchase shares in a company making something else.

Mutual Fund

A mutual fund is a pool of money invested by many individuals or institutions in securities. They are professional managed pools of equity or debt securities, or hybrid securities. The mutual fund's investment objective is usually decided by its board.

Gold

Long-term gold preservation has been documented. Gold can also be considered a safe refuge during economic uncertainty. It can also be used in certain countries as a currency. In recent years, gold prices have risen significantly due to increased demand from investors seeking shelter from inflation. The price of gold tends to rise and fall based on supply and demand fundamentals.

Real Estate

Real estate refers to land and buildings. When you buy real estate, you own the property and all rights associated with ownership. Rent out part of your home to generate additional income. The home could be used as collateral to obtain loans. The home can also be used as collateral for loans. You must take into account the following factors when buying any type of real property: condition, age and size.

Commodity

Commodities include raw materials like grains, metals, and agricultural commodities. As these items increase in value, so make commodity-related investments. Investors looking to capitalize on this trend need the ability to analyze charts and graphs to identify trends and determine which entry point is best for their portfolios.

Bonds

BONDS are loans between governments and corporations. A bond is a loan agreement where the principal will be repaid by one party in return for interest payments. When interest rates drop, bond prices rise and vice versa. Investors buy bonds to earn interest and then wait for the borrower repay the principal.

Stocks

STOCKS INVOLVE SHARES OF OWNERSHIP IN A COMMUNITY. Shares only represent a fraction of the ownership in a business. If you have 100 shares of XYZ Corp. you are a shareholder and can vote on company matters. When the company earns profit, you also get dividends. Dividends, which are cash distributions to shareholders, are cash dividends.

ETFs

An Exchange Traded Fund, also known as an ETF, is a security that tracks a specific index of stocks and bonds, currencies or commodities. ETFs are traded on public exchanges like traditional mutual funds. For example, the iShares Core S&P 500 ETF (NYSEARCA: SPY) is designed to track the performance of the Standard & Poor's 500 Index. This means that if SPY was purchased, your portfolio would reflect its performance.

Venture Capital

Venture capital refers to private funding venture capitalists offer entrepreneurs to help start new businesses. Venture capitalists provide financing to startups with little or no revenue and a high risk of failure. Venture capitalists usually invest in early-stage companies such as those just beginning to get off the ground.