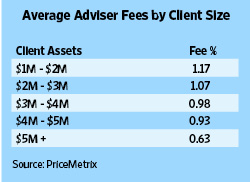

When you need advice on how to invest your money, the choice between hiring an investment adviser and a financial advisor is important. While both are licensed professionals, there are some key differences. The most important difference between them is their fee structure. The fee structure of an investment advisor is often a retainer, which is a percentage the assets they manage. This fee usually ranges from one to two percent, and decreases with the size of your portfolio.

Fiduciary duties

In order to maintain the fiduciary duty between an investment adviser and a client, an advisor must act with the highest degree of good faith and undivided loyalty. Advisors must disclose potential conflicts of interest, and cannot use client's assets to his own advantage. The SEC may impose sanctions on the violators, such as the cancellation of a firm’s registration or a disgorgement of multi-million dollars.

This duty was recognized in SEC. v. Capital Gains. Courts have however questioned the extent to which an advisor has a duty to a client. However, a court has confirmed that an investment adviser has a fiduciary duty to the client and he must act in that person's best interest. The duty of care extends beyond investment strategies and disclosure. Financial advisors will be able and willing to help clients if they have good faith intentions.

Hourly Fee

Asking financial advisors about their fees is a common question. A discount may be offered if you have many investments or a large family. Some will offer a discount if you work with the same advisory firm. Some are open about the fees they charge. Ask about hidden fees and fees based on portfolio size.

Depending on your needs, advisory fees could range from 1.3-1.4 percent of your annual net worth or income. Fees for financial planners generally depend on how much you have in investable assets. A flat rate may be cheaper than a fee that is based only on your portfolio's AUM. You may be able negotiate a fixed fee if you are involved with your portfolio.

Annual fee

When comparing investment advisor costs, there are many things to take into consideration. The standard fee structure for financial advisers is 1% of assets under administration. However, there are some industries that have graduated fee structures with breakpoints. This reduces the annual fee to a lower amount for clients with higher-asset values. For small accounts, some advisors charge higher than 1% while others charge considerably less.

An easy way to compare management costs is to consider the all-in cost, which includes transaction costs as well as underlying fees. Due to the fact that advisors incur platform fees and other costs to manage your money, they charge higher fees than AUM. A study by insiders found that advisors charge 1.65% of AUM as an all-in cost. This is still a large difference, and comparing fees and underlying costs is essential.

Regulations

A financial advisor's relationship with a client is special. According to SEC, an investment advisor is required to act in the best interest of the client. The advisor must notify the client of all conflicts of interests and ensure that they do not affect the advice provided to them. The SEC has made it clear that these rules exist to protect investors and not make the profession untrustworthy.

There are several types of RIAs. Some are fee-only while others earn a commission for selling their clients' financial products. Fee-only advisors charge a low fee, while those who are commission-based receive commissions when they sell financial products like securities or insurance policies. SEC-registered financial advisors must act in clients' best interests.

FAQ

How can I get started with Wealth Management

The first step in Wealth Management is to decide which type of service you would like. There are many types of Wealth Management services out there, but most people fall into one of three categories:

-

Investment Advisory Services. These professionals will assist you in determining how much money you should invest and where. They can help you with asset allocation, portfolio building, and other investment strategies.

-

Financial Planning Services- This professional will assist you in creating a comprehensive plan that takes into consideration your goals and objectives. Based on their expertise and experience, they may recommend investments.

-

Estate Planning Services - An experienced lawyer can advise you about the best way to protect yourself and your loved ones from potential problems that could arise when you die.

-

Ensure they are registered with FINRA (Financial Industry Regulatory Authority) before you hire a professional. If you do not feel comfortable working together, find someone who does.

What is estate plan?

Estate Planning is the process of preparing for death by creating an estate plan which includes documents such as wills, trusts, powers of attorney, health care directives, etc. These documents serve to ensure that you retain control of your assets after you pass away.

How important is it to manage your wealth?

To achieve financial freedom, the first step is to get control of your finances. It is important to know how much money you have, how it costs and where it goes.

Also, you need to assess how much money you have saved for retirement, paid off debts and built an emergency fund.

If you do not follow this advice, you might end up spending all your savings for unplanned expenses such unexpected medical bills and car repair costs.

Statistics

- As previously mentioned, according to a 2017 study, stocks were found to be a highly successful investment, with the rate of return averaging around seven percent. (fortunebuilders.com)

- These rates generally reside somewhere around 1% of AUM annually, though rates usually drop as you invest more with the firm. (yahoo.com)

- Newer, fully-automated Roboadvisor platforms intended as wealth management tools for ordinary individuals often charge far less than 1% per year of AUM and come with low minimum account balances to get started. (investopedia.com)

- As of 2020, it is estimated that the wealth management industry had an AUM of upwards of $112 trillion globally. (investopedia.com)

External Links

How To

How to save on your salary

Working hard to save your salary is one way to save. These steps will help you save money on your salary.

-

You should start working earlier.

-

Reduce unnecessary expenses.

-

Online shopping sites like Flipkart or Amazon are recommended.

-

Do not do homework at night.

-

You should take care of your health.

-

Your income should be increased.

-

You should live a frugal lifestyle.

-

Learn new things.

-

You should share your knowledge with others.

-

You should read books regularly.

-

Make friends with rich people.

-

It's important to save money every month.

-

It is important to save money for rainy-days.

-

You should plan your future.

-

You shouldn't waste time.

-

Positive thinking is important.

-

You should try to avoid negative thoughts.

-

God and religion should be given priority

-

Good relationships are essential for maintaining good relations with people.

-

Enjoy your hobbies.

-

You should try to become self-reliant.

-

Spend less than you make.

-

Keep busy.

-

It is important to be patient.

-

Remember that everything will eventually stop. It is better not to panic.

-

You should never borrow money from banks.

-

Problems should be solved before they arise.

-

It is a good idea to pursue more education.

-

It's important to be savvy about managing your finances.

-

Be honest with all people