Robo advisors offer many benefits, such as automatic rebalancing and tax loss harvesting. There are some downsides. Let's have a look at some features and find out which one works best for us. Also, keep in mind that robo advisors are not a replacement for financial advisors. As a result, they are not a good choice for individuals who want to avoid human interactions.

Robo advisors allow diversification in investing

Robo-advisors are often appreciated for their low-cost investments. However, there are some that are more suitable to individual investors. These types invest in ETFs or index-based exchange traded mutual funds. They do not charge load fee, which can range anywhere from 1% and 3% of a fund's worth. These funds are also known for having low expense ratios. These refer to fees that an advisor must pay in order maintain and market the investments. Index-based ETFs don't require trading activity so they don't incur transaction fees.

Robo-advisors offer investors many advantages over traditional human advisors. These investment systems can also be accessed remotely from anywhere that has an internet connection. Automated systems are also cheaper than manual ones, and clients can avoid paying expensive fees and minimal investment requirements. Another benefit of automated algorithms is that they are much better at tax harvesting than human advisors. They tend to eliminate biases in programming, but they can still introduce them during programming.

Automated rebalancing

The robo-advisor's automatic rebalancing feature allows traders to track their portfolio's performance, and keep their eyes on their goals. It automatically realigns all the securities and asset classes in the portfolio. It is usually performed automatically and periodically using an algorithm. Rebalancing in financial planning can be very time-consuming and expensive. Automatic rebalancing with robo advisors can be a great benefit.

While robot-advisors might be helpful when investing in stocks that are more traditional, they may not be the best choice for more complex situations. Many people expressed concern about the lack if complexity and empathy that human financial advisers can provide. For example, Betterment's robo-advisors rebalance portfolios, putting money into stocks that match market trends. Its goal was to make passive buy-and-hold investing easy through a user-friendly online interface. It acquired Makara, an online company that developed cryptocurrency portfolios, in 2022.

Tax loss harvesting

There are some important things to remember when comparing tax-loss harvesting robot advisors with traditional financial advisers. They do not require a minimum balance. They can be used to maximize your tax losses harvesting. They can also offer tax minimization strategies.

These calculations are also performed by some robo-advisors, apart from tax-loss-harvesting. However, not all of them provide these services, and some only offer them to higher-paying clients. These robo advisers can help to keep your portfolio on the right track, by strategically selling investments in times of market decline. This strategy will help your portfolio be more resilient to future market declines.

Absence of human contact

One study that compared financial advisers with robot-advisors discovered that human advisors had more trust in clients than robos. Researchers speculated that this could be due to whether a client chooses a human financial adviser over a robot-advisor.

A recent study by Vanguard found that robo-advisors and human financial advisors both add value to portfolios. However, researchers couldn't compare actual investment returns. So they asked clients for estimates of how much their portfolio might have grown if they didn't have a financial adviser. The average annual return for clients with human advisors was 15%, compared to 10% for those without one. So what is it that makes a human adviser so valuable?

FAQ

How to Beat Inflation with Savings

Inflation is the rise in prices of goods and services due to increases in demand and decreases in supply. Since the Industrial Revolution people have had to start saving money, it has been a problem. The government regulates inflation by increasing interest rates, printing new currency (inflation). But, inflation can be stopped without you having to save any money.

Foreign markets, where inflation is less severe, are another option. An alternative option is to make investments in precious metals. Because their prices rise despite the dollar falling, gold and silver are examples of real investments. Investors who are concerned about inflation are also able to benefit from precious metals.

What are the best strategies to build wealth?

It is essential to create an environment that allows you to succeed. You don't need to look for the money. If you're not careful you'll end up spending all your time looking for money, instead of building wealth.

You also want to avoid getting into debt. While it's tempting to borrow money to make ends meet, you need to repay the debt as soon as you can.

You're setting yourself up to fail if you don't have enough money for your daily living expenses. If you fail, there will be nothing left to save for retirement.

It is important to have enough money for your daily living expenses before you start saving.

What is risk management in investment management?

Risk management is the act of assessing and mitigating potential losses. It involves monitoring and controlling risk.

An integral part of any investment strategy is risk management. The goal of risk-management is to minimize the possibility of loss and maximize the return on investment.

These are the core elements of risk management

-

Identifying sources of risk

-

Monitoring and measuring the risk

-

Controlling the Risk

-

How to manage the risk

How old do I have to start wealth-management?

Wealth Management can be best started when you're young enough not to feel overwhelmed by reality but still able to reap the benefits.

The sooner that you start investing, you'll be able to make more money over the course your entire life.

If you want to have children, then it might be worth considering starting earlier.

You may end up living off your savings for the rest or your entire life if you wait too late.

Where To Start Your Search For A Wealth Management Service

You should look for a service that can manage wealth.

-

Has a proven track record

-

Locally located

-

Offers free initial consultations

-

Provides ongoing support

-

Is there a clear fee structure

-

Reputation is excellent

-

It's simple to get in touch

-

We offer 24/7 customer service

-

Offering a variety of products

-

Low fees

-

No hidden fees

-

Doesn't require large upfront deposits

-

Make sure you have a clear plan in place for your finances

-

Is transparent in how you manage your money

-

Makes it easy to ask questions

-

Does your current situation require a solid understanding

-

Understands your goals and objectives

-

Is willing to work with you regularly

-

Works within your budget

-

A good knowledge of the local market

-

We are willing to offer our advice and suggestions on how to improve your portfolio.

-

Are you willing to set realistic expectations?

What are the benefits to wealth management?

Wealth management has the main advantage of allowing you to access financial services whenever you need them. It doesn't matter if you are in retirement or not. If you are looking to save money for a rainy-day, it is also logical.

To get the best out of your savings, you can invest it in different ways.

To earn interest, you can invest your money in shares or bonds. To increase your income, you could purchase property.

If you use a wealth manger, someone else will look after your money. This means you won't have to worry about ensuring your investments are safe.

Statistics

- According to Indeed, the average salary for a wealth manager in the United States in 2022 was $79,395.6 (investopedia.com)

- According to a 2017 study, the average rate of return for real estate over a roughly 150-year period was around eight percent. (fortunebuilders.com)

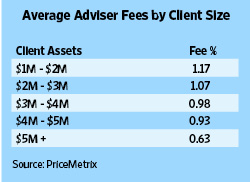

- If you are working with a private firm owned by an advisor, any advisory fees (generally around 1%) would go to the advisor. (nerdwallet.com)

- A recent survey of financial advisors finds the median advisory fee (up to $1 million AUM) is just around 1%.1 (investopedia.com)

External Links

How To

How to Invest Your Savings to Make Money

You can generate capital returns by investing your savings in different investments, such as stocks, mutual funds and bonds, real estate, commodities and gold, or other assets. This is called investment. You should understand that investing does NOT guarantee a profit, but increases your chances to earn profits. There are many ways you can invest your savings. One of these options is buying stocks, Mutual Funds, Gold, Commodities, Real Estate, Bonds, Stocks, ETFs, Gold, Commodities, Real Estate, Bonds, Stocks, Real Estate, Bonds, and ETFs. These methods are described below:

Stock Market

Because you can buy shares of companies that offer products or services similar to your own, the stock market is a popular way to invest your savings. Also, buying stocks can provide diversification that helps to protect against financial losses. In the event that oil prices fall dramatically, you may be able to sell shares in your energy company and purchase shares in a company making something else.

Mutual Fund

A mutual fund refers to a group of individuals or institutions that invest in securities. They are professionally managed pools, which can be either equity, hybrid, or debt. The mutual fund's investment goals are usually determined by its board of directors.

Gold

Gold is a valuable asset that can hold its value over time. It is also considered a safe haven for economic uncertainty. Some countries use it as their currency. The increased demand for gold from investors who want to protect themselves from inflation has caused the prices of gold to rise significantly over recent years. The supply/demand fundamentals of gold determine whether the price will rise or fall.

Real Estate

Real estate refers to land and buildings. Real estate is land and buildings that you own. Rent out a portion your house to make additional income. You can use your home as collateral for loan applications. The home may also be used to obtain tax benefits. Before purchasing any type or property, however, you should consider the following: size, condition, age, and location.

Commodity

Commodities can be described as raw materials such as metals, grains and agricultural products. These items are more valuable than ever so commodity-related investments are a good idea. Investors looking to capitalize on this trend need the ability to analyze charts and graphs to identify trends and determine which entry point is best for their portfolios.

Bonds

BONDS are loans between governments and corporations. A bond is a loan in which both the principal and interest are repaid at a specific date. The interest rate drops and bond prices go up, while vice versa. Investors buy bonds to earn interest and then wait for the borrower repay the principal.

Stocks

STOCKS INVOLVE SHARES OF OWNERSHIP IN A COMMUNITY. Shares only represent a fraction of the ownership in a business. If you own 100 shares, you become a shareholder. You can vote on all matters affecting the business. When the company is profitable, you will also be entitled to dividends. Dividends are cash distributions paid out to shareholders.

ETFs

An Exchange Traded Fund, also known as an ETF, is a security that tracks a specific index of stocks and bonds, currencies or commodities. Unlike traditional mutual funds, ETFs trade like stocks on public exchanges. The iShares Core S&P 500 (NYSEARCA - SPY) ETF is designed to track performance of Standard & Poor’s 500 Index. This means that if SPY is purchased, your portfolio will reflect the S&P 500 performance.

Venture Capital

Venture capital is private financing venture capitalists provide entrepreneurs to help them start new businesses. Venture capitalists provide financing to startups with little or no revenue and a high risk of failure. Venture capitalists usually invest in early-stage companies such as those just beginning to get off the ground.