College students should be able to control their food budget to help them save money. Patricia is able to use a bike to travel around the city and has free access to public transportation. Lyft and Uber are also available for short trips. Food costs are usually about $50 per week, but she can stretch this out by adding fresh fruit and veggies to leftovers. Patricia spends the rest on food to indulge in nice dinners or bar tabs.

The basics of budgeting for college students

Budgeting is all about prioritizing. This is the key principle for college students. The most important principle in budgeting for college students is setting priorities. Wants are items people want but cannot afford. This is important in college, as if you can't control your spending, you may end up borrowing more student loans or delaying graduation. You can use a budgeting spreadsheet to keep track of your spending. Wants are more luxurious items, such as entertainment or fashion.

While it might seem daunting to set up a budget, it is actually very easy and can help control your spending. College students should plan a weekly budget and see how close they can come to their actual expenses. The most common area for mismanagement is food. It's important to budget for food, as you will be eating out almost every day. Your food expenses are among the largest. Find ways to reduce them.

How to calculate a budget of one number

First, you should know how much your expected monthly income is. Add fixed expenses such as rent, subscriptions, or monthly loan payments to that number. Then subtract any expenses other than monthly, like savings contributions. This will give you a fixed amount to spend on variable expenses like entertainment, clothes, and food. You should ensure that you have enough money saved for unexpected expenses, and extra cash for emergency situations.

Once you have all of the expenses, you are able to break them up into subcategories. There might be subcategories for coffee, food, and dining out. You can also add the cost of dining out. By making a budget for these categories, you'll know what to expect each month and where to cut back. It can help plan ahead and save you money.

Monitoring spending on a college student's budget

You must keep track of all your expenses, especially if you're a college student struggling to stick to a college budget. This is a great way for you to be accountable and help you get out of debt. However, it can be challenging to track your expenses. Here are some tips to help track your expenses.

First, determine what you can afford to pay for college expenses. While some expenses will remain constant throughout your college career, others will change over time. To create a college budget that is as accurate and informed as possible, you need to determine which expenses can be fixed and which expenses can fluctuate. The tuition costs for each course are the first. Tuition costs are affected by the number and location of the courses, as well as the institution and region. Some colleges charge tuition by the credit hour, while others charge a flat rate for each semester or quarter. The latter can be a good way to save money.

Using a digital tool to track spending

To keep track of your spending on a college student budget, try using an app. Prism is one example of an app that can help you keep track and manage your finances. It syncs to your bank account so that you know how much money you still have at the end. The digital tool allows you to easily track spending and is free.

Simple is an easy-to-use app for budgeting. It lets you set timeline goals for different spending categories. It also allows you to visualize your expenses so that you can see exactly where you are spending your money. It allows you to automatically set money aside, rounding each transaction to the nearest $1 and depositing the difference in your savings account. This feature makes budgeting simple because you can easily see how much your spending is on the things you really need.

FAQ

What is risk management and investment management?

Risk management refers to the process of managing risk by evaluating possible losses and taking the appropriate steps to reduce those losses. It involves identifying and monitoring, monitoring, controlling, and reporting on risks.

Any investment strategy must incorporate risk management. The goal of risk management is to minimize the chance of loss and maximize investment return.

These are the main elements of risk-management

-

Identifying the risk factors

-

Measuring and monitoring the risk

-

How to reduce the risk

-

How to manage risk

How much do I have to pay for Retirement Planning

No. This is not a cost-free service. We offer free consultations to show you the possibilities and you can then decide if you want to continue our services.

What are the best ways to build wealth?

Your most important task is to create an environment in which you can succeed. You don't want to have to go out and find the money for yourself. If you aren't careful, you will spend your time searching for ways to make more money than creating wealth.

You also want to avoid getting into debt. While it's tempting to borrow money to make ends meet, you need to repay the debt as soon as you can.

If you don't have enough money to cover your living expenses, you're setting yourself up for failure. And when you fail, there won't be anything left over to save for retirement.

It is important to have enough money for your daily living expenses before you start saving.

How old can I start wealth management

Wealth Management is best done when you are young enough for the rewards of your labor and not too young to be in touch with reality.

The sooner that you start investing, you'll be able to make more money over the course your entire life.

If you want to have children, then it might be worth considering starting earlier.

If you wait until later in life, you may find yourself living off savings for the rest of your life.

What is wealth management?

Wealth Management is the practice of managing money for individuals, families, and businesses. It includes all aspects of financial planning, including investing, insurance, tax, estate planning, retirement planning and protection, liquidity, and risk management.

Who can I turn to for help in my retirement planning?

Many people consider retirement planning to be a difficult financial decision. It's more than just saving for yourself. You also have to make sure that you have enough money in your retirement fund to support your family.

The key thing to remember when deciding how much to save is that there are different ways of calculating this amount depending on what stage of your life you're at.

If you are married, you will need to account for any joint savings and also provide for your personal spending needs. If you're single, then you may want to think about how much you'd like to spend on yourself each month and use this figure to calculate how much you should put aside.

If you are working and wish to save now, you can set up a regular monthly pension contribution. If you are looking for long-term growth, consider investing in shares or any other investments.

These options can be explored by speaking with a financial adviser or wealth manager.

How do I get started with Wealth Management?

You must first decide what type of Wealth Management service is right for you. There are many Wealth Management options, but most people fall in one of three categories.

-

Investment Advisory Services – These experts will help you decide how much money to invest and where to put it. They advise on asset allocation, portfolio construction, and other investment strategies.

-

Financial Planning Services - This professional will work with you to create a comprehensive financial plan that considers your goals, objectives, and personal situation. He or she may recommend certain investments based on their experience and expertise.

-

Estate Planning Services: An experienced lawyer will advise you on the best way to protect your loved ones and yourself from any potential problems that may arise after you die.

-

Ensure that a professional you hire is registered with FINRA. If you are not comfortable working with them, find someone else who is.

Statistics

- US resident who opens a new IBKR Pro individual or joint account receives a 0.25% rate reduction on margin loans. (nerdwallet.com)

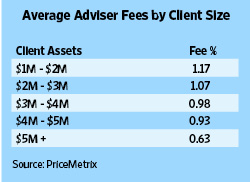

- If you are working with a private firm owned by an advisor, any advisory fees (generally around 1%) would go to the advisor. (nerdwallet.com)

- According to a 2017 study, the average rate of return for real estate over a roughly 150-year period was around eight percent. (fortunebuilders.com)

- According to Indeed, the average salary for a wealth manager in the United States in 2022 was $79,395.6 (investopedia.com)

External Links

How To

How do I become a Wealth advisor?

If you want to build your own career in the field of investing and financial services, then you should think about becoming a wealth advisor. This career has many possibilities and requires many skills. If you possess these qualities, you will be able to find a job quickly. A wealth advisor is responsible for giving advice to people who invest their money and make investment decisions based on this advice.

You must choose the right course to start your career as a wealth advisor. It should include courses such as personal finance, tax law, investments, legal aspects of investment management, etc. After you complete the course successfully you can apply to be a wealth consultant.

Here are some suggestions on how you can become a wealth manager:

-

First, let's talk about what a wealth advisor is.

-

Learn all about the securities market laws.

-

You should study the basics of accounting and taxes.

-

After completing your education you must pass exams and practice tests.

-

Finally, you must register at the official website in the state you live.

-

Apply for a Work License

-

Take a business card with you and give it to your clients.

-

Start working!

Wealth advisors often earn between $40k-60k per annum.

The size and location of the company will affect the salary. You should choose the right firm for you based on your experience and qualifications if you are looking to increase your income.

We can conclude that wealth advisors play a significant role in the economy. Everyone should be aware of their rights. You should also be able to prevent fraud and other illegal acts.